Student Loan Promissory Note: Objective, Contents, and Legality

The percentage of students taking student loan in the country is getting higher by year. It is because education, particularly tertiary education, becomes more and more expensive. If you even take a loan for your study, you will be likely to recognize a student loan promissory note. What is the note about? What are the contents of this note? You will learn about it in the following part.

Student Loan Promissory Note Objective

What is the main objective of this note? First of all, you need to know that this note is made for parties involved in the loan: the lender and borrower. Lender can be a bank or other types of financial institution. Meanwhile, borrower means student who takes the loan to fund their education.

- School Excuse Note

- Sympathy Thank You Note

- Medical Progress Note Template

- Blank Promissory Note Templates

- Guided Note Template

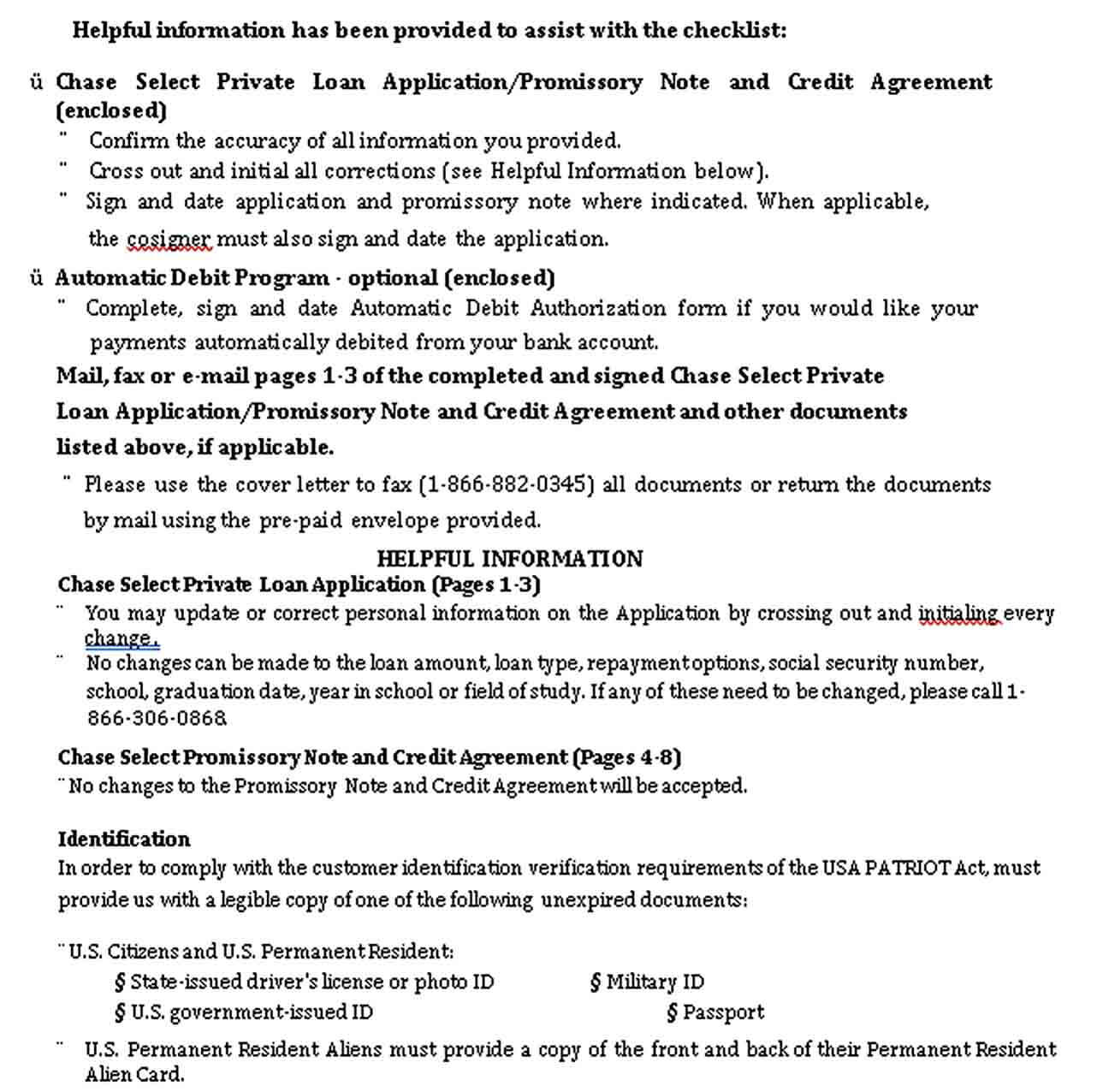

In any kind of loan, there should be terms of agreement between both parties. That is what this note is about. It has contractual tone which encompasses every aspect in the loan, particularly the promise to pay off the loan. The note will provide explanation about how student is going to pay it off and other kind of information. It is important to note that both parties need to be aware of the note’s contents.

Student Loan Promissory Note Contents

Here are the contents of student loan promissory note.

- The amount being loaned

You can find out the amount of money that being loaned in the promissory note. It is not the same as the amount of money that student needs to pay after they graduates and gets a job, though. The lender may apply interest to that original amount as well as adjusting nominal to economic fluctuations.

- Date of payment

The next part of your note should include the date of payment. Normally, a student loan is not something that you should pay one time in a lump sum. Instead, you need to pay smaller amount every month for several years. The note will provide information on how much to pay every month and the predicted period of payment.

- Terms of agreements

This includes what happens if student bails out from making payment. Usually the case will end up in court because this loan is a type of unsecured loan.

- Signs

Both parties must provide their information (names) at the end of this document. After that, they have to sign it under the date of the note creation.

Student Loan Promissory Note Legality

Since the student loan promissory note is signed by both parties involved in the loan (perhaps with addition third party in some loan cases), the contents of this note is legally binding. Borrower must adhere to the rules and pay the exact amount required at designated period. If not, the case can be brought to the court and borrowers will be asked to pay penalty and even risk themselves going to jail.

Student Loan Promissory Note Template Examples

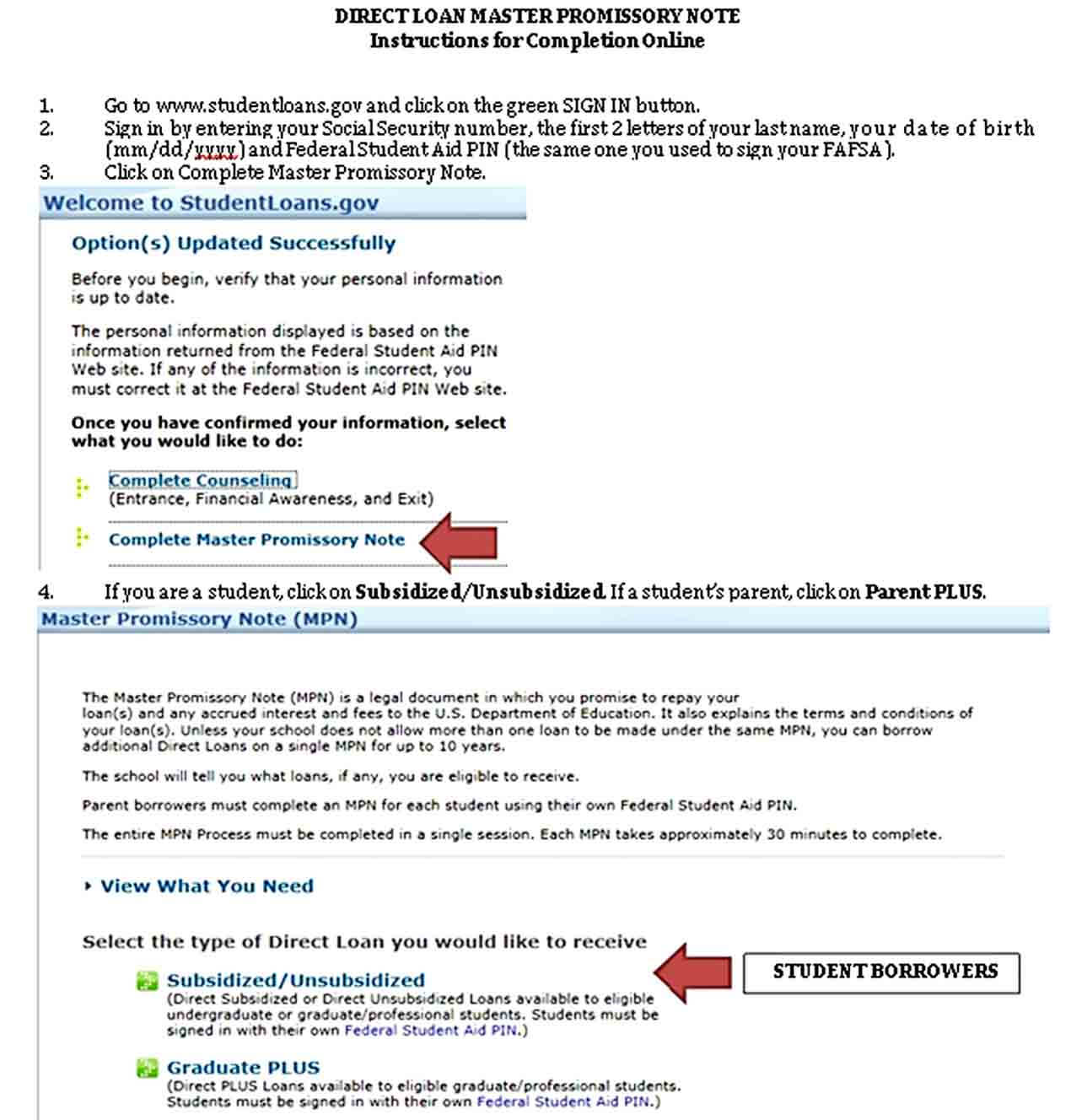

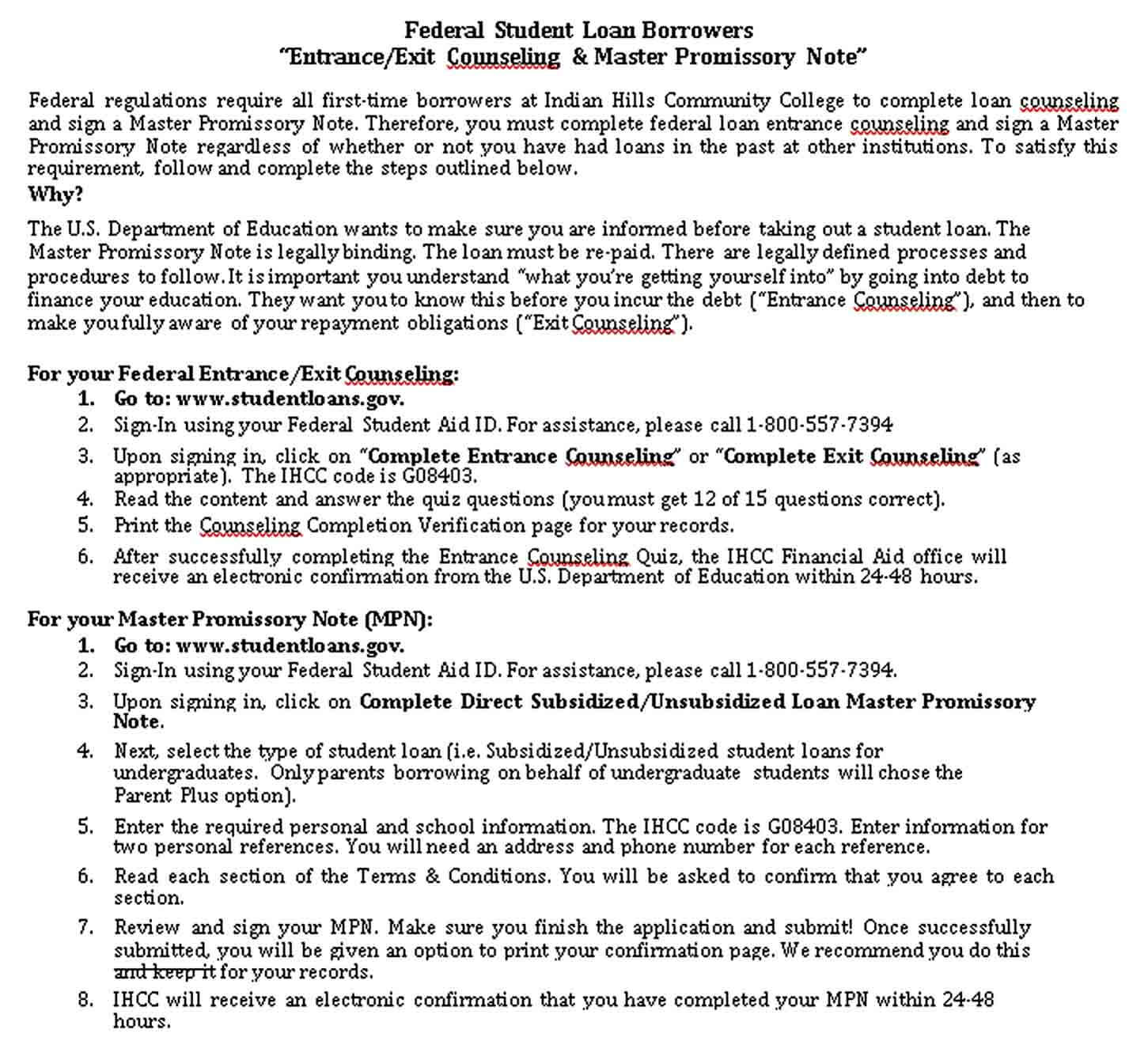

Before you are taking the loan, it would be better to look at few student loan promissory note examples available in this web page. That will help you recognizing the structure of this note better and thus handling it well. There are examples of bank’s note template and the note in general.

Similar Posts:

- Loan Promissory Note

- Assignment of Promissory Note

- Mortgage Promissory Note

- Small Business Promissory Note

- Master Promissory Note

- Blank Promissory Note Templates

- Secured Promissory Note

- Promissory Note Form

- Debit Note Templates

- Note Template for Personal Loan

- International Promissory Note

- Promissory Note Template

- Demand Note Template

- Sales Note Template

- Transfer Note Templates

- Negotiable Promissory Note

- Reminder Note Template

- Credit Note Templates